HOA Accounting Standards the Board Must Set Up

Garota de Programa Ribeirão Preto - SP

Perfil

- Cidade: Ribeirão Preto - SP

- Eu Sou:

Apresentação:

As the association’s treasurer, you’re responsible for keeping accurate records and financial reports. If an Accounts Payable Report tracks your association’s debts, an Accounts Delinquency Report tracks amounts owed to the association. Let’s be honest — collecting monthly fees and assessments from homeowners can be tough. However, it can be twice as difficult when you have no records of their debts.

If so, it is relatively inexpensive to hire an accountant as needed to prepare balance sheets. Doing this ensures that all the information will be completed in a timely manner. It also removes the need to take time out of community volunteers’ busy schedules. This alone relieves some of that stress from the board members as well.

The property manager works closely with the HOA, but ultimately the board retains decision-making power. If you’re on the hunt for an HOA management company, our online directory lists the best ones by location. Recording your financial transactions in this spreadsheet will allow you to identify any seasonal trends or potential gaps in your finances.

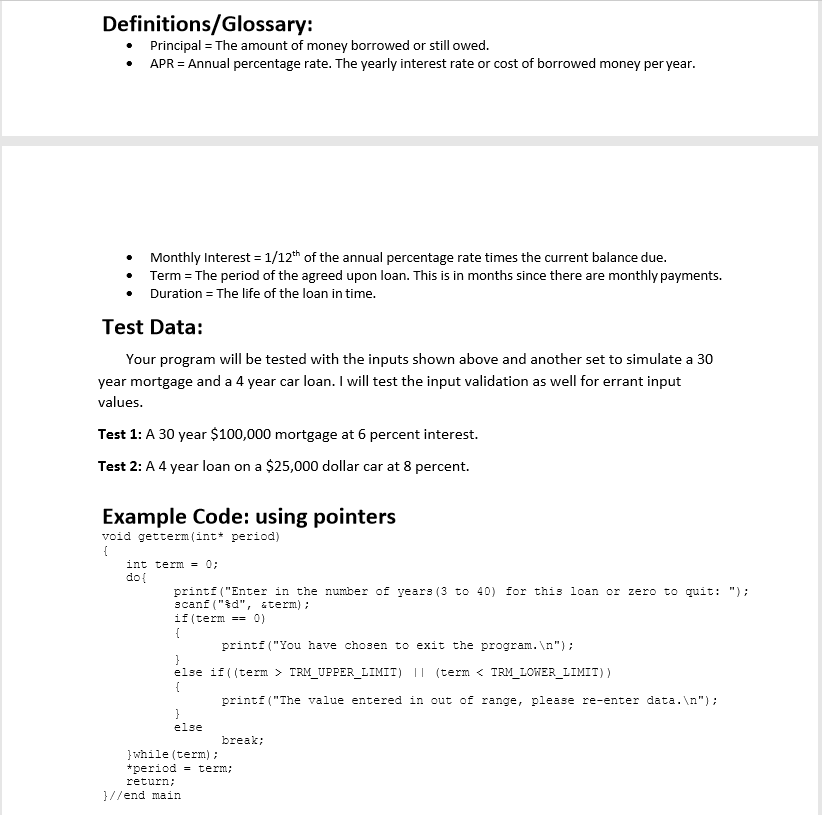

If you’re interested in using accrual based accounting, find out how your HOA can adopt accrual financial statements. Buildium is a property management software that can be used for HOAs as well. It provides property managers with efficient software that is easy to use, even for people who aren’t confident with new technology. Buildium focuses on streamlining tasks so that you spend less time on them. AppFolio Property Manager has some great accounting features for HOAs, including bill entry and automated accounts payable.

HOAs must invoice homeowners, collect and manage dues and fees, pay vendors, perform maintenance and other upkeep tasks as part of their daily operations. Moreover, it’s worth considering that these solutions are tailored to your business model – reducing the risk of errors arising that could be costly for your business. Invest in a reliable, effective homeowners’ association package instead. Undeniably, it’s a far more reliable and tailored solution all the same than choosing a generic brand, such as QuickBooks, that doesn’t actually specialize in supporting homeowners’ association businesses. When the Board does all the financial management work by themselves, it gives an illusion of better control than having an outside company do the financial management – but it is just that – an illusion.

Comprehensive Guide to HOA Bookkeeping: Pros and Cons of Outsourcing to an External Bookkeeper

Even a small increase can negatively impact the budget if the association isn’t prepared for it. Most HOAs use the Accrual Basis, as it is generally thought to give the most accurate picture of your association’s actual financial condition. However, it is always best to familiarize yourself with your state laws, as some states specify which accounting method HOAs have to use. Homeowners can access their personalized accounts to make and track payments, get updates about the community, send requests and communications, and even keep in touch with one another through a shared message board. These ledgers are typically applied on a per-unit base and outline the current accounting status, helping streamline your management. Ever feel like your association budget would be just fine if it didn’t have to deal with unit owners that didn’t pay on time?

- However it is not designed for HOA or Condos and does not offer online functionality for owners to make payments or see community documents.

- Connect your Stripe Account to MoneyMinder PRO to directly download transactions, saving you time and effort.

- A majority of experts and accountants agree that the Accrual Basis is the best accounting method to use.

- For an HOA financial statement to be effective, proper preparation is key.

- As such, accounting tasks must be taken seriously, and treated like a real job.

- Buildium focuses on streamlining tasks so that you spend less time on them.

It is a complete record of all financial transactions, organized by account and date, that is used to generate financial statements and reports. An HOA accounting software with a general ledger and financial reporting tools can provide a clear and accurate view of the HOA’s financial health. The financial statements resulting from accrual accounting are less precise than cash flow statements but are at the same time more complex and more useful. The accrual basis of accounting is essentially a process of recording cash inflows and outflows of all four types. Whether your HOA’s governing documents require it or not, it is often recommend that associations with a large cash flow get an annual audit.

Understanding HOA Accounting

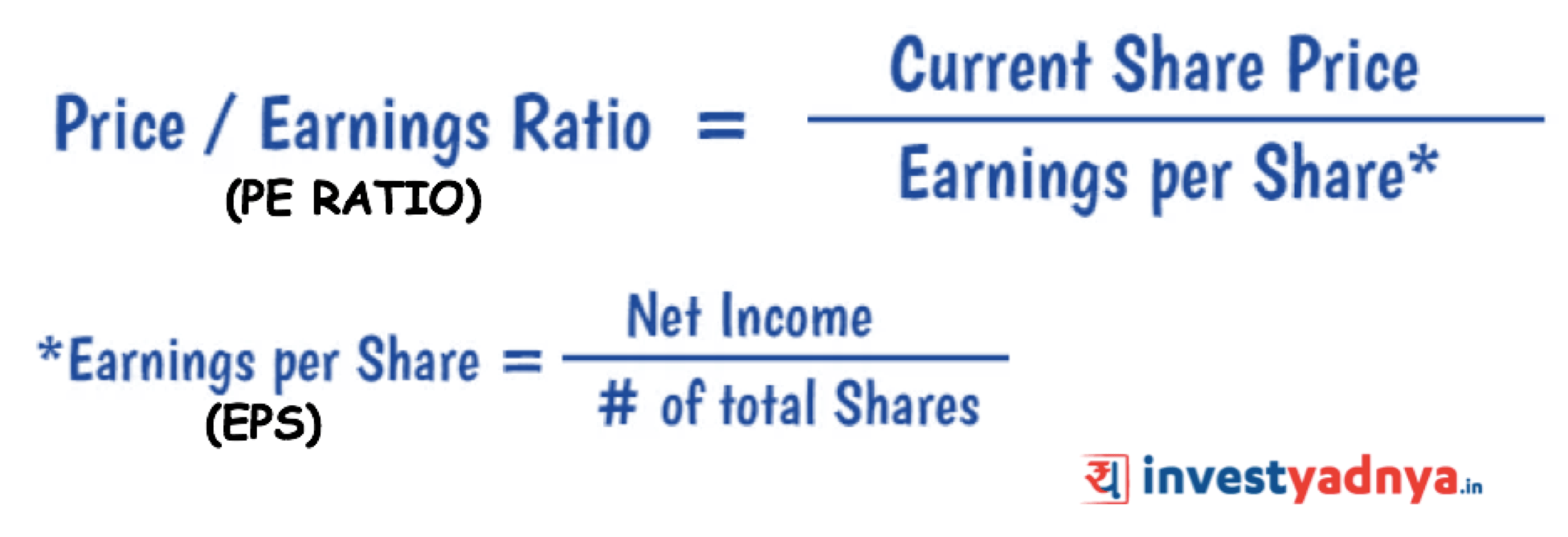

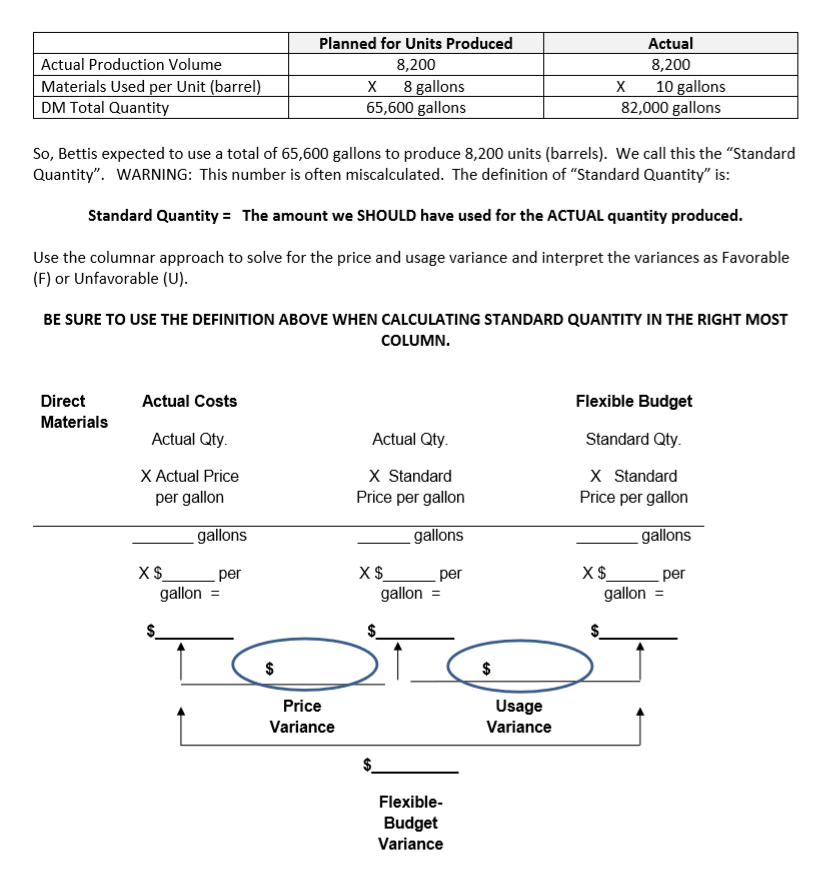

On the other hand, liabilities are where you record amounts you owe (i.e. accounts payable). While you may have already received the money, prepaid assessments have yet to be earned. Understanding the three methods of accounting is the first step toward accurate financial recording. As a board member, it’s your responsibility to report all financial transactions with care and precision. That means choosing the best accounting method for HOAs for all reporting and sticking to it.

Revenue and expenses are recorded immediately, even if money has not been exchanged. This gives the most complete and accurate picture of HOA finances, conforming with Generally Accepted Accounting Principles (GAAP). As with most things regarding HOA financial statements, it depends on state laws and community bylaws. These documents will be available to everyone in the community, most of which do not have advanced accounting degrees. For an HOA financial statement to be effective, proper preparation is key. Making it too complicated alienates people and hinders community relations.

Payments Go Directly to The Bank

Many HOA management companies offer accounting and other financial services as part of a package deal. A good way to keep track of your income and expenses over the course of a 12-month period is to create an HOA accounting spreadsheet. Lastly, the cash disbursements ledger lists down all of the checks your association has written and issued for the period specified. Otherwise known as a check register, this report consists of information such as the check’s recipient, the check date, and a description of the expense. It should also outline the check numbers, chart of accounts numbers, and any related invoice numbers.

- Much like a business, a functioning community incurs costs and earns revenue.

- PayHOA is the single portal where you can connect directly with the needs of your homeowners.

- Most CIRAs, however, have annual meetings at which financial statements for the preceding year and budgets for the following year are presented to unit owners.

Your income statement depicts your association’s income and expenses for the period specified (usually for the month). It lists down all your revenues as well as your expenses, deducting the latter from the former to arrive at your net income or loss. Accounts Payable – The accounts payable report lists all unpaid invoices as of the end of the accounting period. Regardless, interested individuals don’t need to understand every single aspect of accounting for homeowners associations. After all, they have the option of entrusting such matters to reliable and reputable accountants. However, interested individuals should still develop at least some understanding of accounting basics because that will make it much easier for them to follow everything around them.

How to Write an HOA Violation Letter (with Examples)

That being said, if you find yourself in a position where financial responsibilities are becoming overwhelming, it’s in everyone’s best interest to hire a professional who can get the association back on track. If the HOA runs out of money, this forces the board to either take out a loan, or charge special assessments to homeowners. Neither option is ideal, and the latter option never sits well with owners. Plus, Hoa accounting having to resort to one of these options deters new owners from moving in, and may encourage current owners to move out. As an HOA Board Member, you must have a basic understanding of your association’s accounting and finances, but in-depth accountancy can be complex and overwhelming. Enlisting the help of professionals to streamline your processes and ensure best practices are followed is highly recommended.

Board members are volunteers, and while they work very hard to serve their community, most feel apprehensive about managing such a significant amount of money. Hiring a third-party property manager can come at a cost of tens of thousands of dollars per year. Software is a cost-effective and worthwhile alternative for self-managed HOAs. Many platforms allow associations to try them out for a risk-free trial, a great opportunity to find the best software for your community.

What Are HOA Accounting Services? Everything You Need to Know

Nearly all individual taxpayers prepare their returns on this modified cash basis. Also many physicians, law firms, other professional firms, and small service-type businesses rely on a modified cash basis of accounting. With this thought to hand, it’s worth considering that most HOA management software provides unique solutions compared to traditional accounting software since it is specialized toward homeowners’ associations exclusively. Civil Code Section 5300(b)(1) requires that the annual operating budget distributed to the membership every year follow the accrual basis. The law requires associations to prepare pro forma operating budgets that include all estimated expenses and revenues using the accrued basis method of accounting. Although this sub-section addresses reserves, the implication in the other sub-sections is that the homeowners association board is required to review the financial information for both operating and reserve activities.

How Tennessee neighbors battle over Airbnb rentals could resolve – Knoxville News Sentinel

How Tennessee neighbors battle over Airbnb rentals could resolve.

Posted: Fri, 11 Aug 2023 09:13:49 GMT [source]

At the same time, they will record the same amount on the right side of the ledger as a credit. If the homeowners association pays the expense in cash right away, that credit will be a deduction to its cash. In contrast, if the homeowners association intends to pay the expense in the future, that credit will be a liability called a payable.

Generally speaking, interested individuals will see income statements covering either a month, a quarter, or a year. In any case, income statements are what they sound like, which is to say, a summary of revenues and expenses for the relevant period culminating in either a profit or a loss. Real-time balances are an important feature of HOA accounting software because they provide an up-to-date and accurate view of the HOA’s financial status.

Backed by more than three decades of experience, the staff from our organization is ready to assist your homeowners’ association today and in the future. HOA Accounting Incorporated provides first-rate HOA bookkeeping service and allows our clients access to our full-service property management system at no additional costs. Our sole purpose of existence is to help communities solve their HOA accounting needs at minimal costs while assisting the board of directors to manage their community in the most efficient and cost-effective manner. We want to educate the HOA communities that there are better, more efficient ways to manage their communities while being financially responsible. Which basis of accounting should be used when preparing your homeowners association’s interim (monthly, quarterly and annual) financial statements?

6 Ways to Help Home Buyers Compete With Investors – NAR.realtor

6 Ways to Help Home Buyers Compete With Investors.

Posted: Wed, 09 Aug 2023 07:00:00 GMT [source]

Reliable, consistent, and transparent financial statements not only help the HOA board of directors make well-informed decisions. It also supports community health by allowing all community residents and stakeholders to be a part of the team. Keeping members in the dark only promotes mistrust and working with inadequate or no financial information can lead to dwindling reserves for community upkeep and new projects. The most common mistake that people make when preparing HOA financial statements is not adding enough detail.

If you have a separate Accounts Payable Report, you have no way of verifying the amounts against the Balance Sheet. Straying from the regular schedule only causes issues between the board members and homeowners. When dealing with financial information, it is best to be open and honest in as much detail as is appropriate. If a certain expense spiked compared to a previous month or year, this spreadsheet will tell you that in a single look.

Also known as the Modified Cash Basis, the Modified Accrual Basis of accounting combines the Cash Basis with the Accrual Basis methods. The Modified Accrual Basis method is unique because revenues are recorded as soon as they are earned, but expenses are only recorded when payment has been made. In this case, accounts like assessments receivable and prepaid assessments will appear on the balance sheet, but liability accounts such as accounts payable will not appear. Like the Cash Basis, this method can only be used for interim or unofficial reporting. CINC Systems provide robust accounting and HOA management software modules.