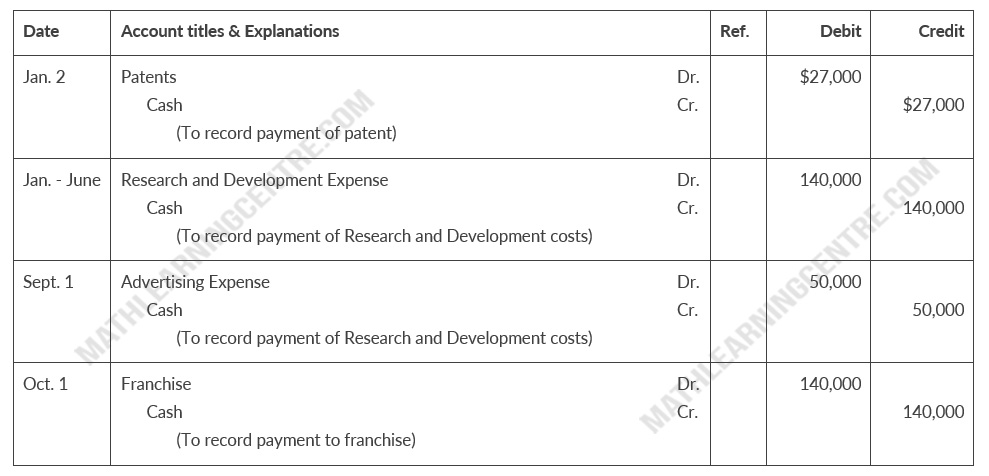

Chapter 9 Solutions CHAPTER 9 Plant Assets, Natural Resources, and Intangible Assets ASSIGNMENT

Garota de Programa Ribeirão Preto - SP

Perfil

- Cidade: Ribeirão Preto - SP

- Eu Sou:

Apresentação:

Contents

When you place an insurance claim on fixed assets, you must take certain accounting steps. Remove the asset from your books, but record the payout as a proceed. You can record the transaction when payment is possible or when you receive it. If the insurance policy carries a coinsurance clause, you are required to carry insurance to cover at least 60% of the asset’s fair market value. Asset disposal requires that the asset be removed from the balance sheet. Disposal indicates that the asset will yield no further benefits.

When not carrying passengers up and down the country, trains in the UK are maintained in specialised depots. These depots are full of complex plant and equipment, which are relied upon to keep the transport systems safe and reliable. If depot plant fails, trains may not run – resulting in potential impact on rail users, and disruption to the rail network.

Impairment Loss Journal Entry

To begin with, a detailed appraisal should be carried out, looking at exactly how the current plant performs, what the current costs of maintenance are and where the hot spots lie. By comparing what the equipment does with what it’s supposed to do, a greater understanding of relative risk ensues and less essential tasks can be classified accurately. Ideally, with planned maintenance being seen as two to three times more cost effective for customers, Ofwat is looking to reduce reactive approaches and move to greater emphasis on planned or predictive maintenance. “The trouble has been that many treatment processes based on simple and robust equipment can continue for long periods at deteriorating or relatively low efficiency with minimal maintenance regimes in place. Accumulated depreciation refers to all of the depreciation that has been recorded on an asset up to a specified date . Accumulated depreciation is recorded as a credit on the company’s balance sheet.

Is vehicle a fixed asset?

Yes, a car is regarded as a fixed asset or capital asset as it is useful for the business in the long term.

An asset is a long-life asset if it is plant or machinery which would reasonably be expected to have a useful economic life of at least 25 years when new. This method accounts for the expense of a longer-lived asset that quickly loses its value or becomes obsolete. Examples of assets that should use the double declining methods are computer equipment, expensive cell phones and other technology that has more value at the beginning of its life than at the end.

(a) Cost of land

For example, if a fire destroyed the same $6,000 classroom but the payout was $7,000, you have a gain in proceeds of $1,000. Disregard significant changes in circumstances for an asset, as it may be subject to impairment. Consider asset impairment when significant events or changes in circumstances occur. The remaining life is how many years from the purchase year you assume are left. For example, a manufacturing company purchases a machine on Dec. 1, 2019 for $56,000.

This does not mean that should apply the long-life asset test to each component separately. Dedicated fixed-asset accounting software can calculate depreciation and record other relevant details. Online platforms remove the burden of multiple manual entries, improve reporting and facilitate audit trails.

(To record annual depreciation on mower)

Accounting for depreciation helps to improve a company’s understanding of its asset turnover and quantify how much the value of the asset justifies its cost. Identify and implement an annual programme of site visits to verify assets and audit plant marijuanacoin and vehicle processes and procedures. Carry out Quality, Health & Safety and environmental audits and report findings to the senior management team. For accounting purposes, depreciation does not actually represent any kind of cash transaction.

Is capital an asset?

Capital is used to create wealth for the business, therefore it is classified as an asset in accounting.

Upon completion, an accountant will move the asset to the appropriate fixed-asset account. Rushton International provides asset management solutions that are tailored to our clients’ needs. Our work ranges from asset verification, preparation of computerised asset registers and updating asset registers.

No asset exists in the initial planning and R&D stages, so you must expense costs. During product development, expense costs spent directly towards creating product. Capitalise only the cost of development and test team salaries and other costs spent directly on the product. If your organisation builds an asset and you borrowed money to pay for the work, the cost comprises all components, including materials, labour, overhead and any interest expense. Capitalise any additions you made to extend the service life or capability of the asset.

Negotiated purchase price ………………………………………. £24,

You just need to keep a record of exactly what you’ve purchased, and work with your accountant to understand the useful life of the item. You can then apply proper depreciation values when preparing your accounts. Tangible assets lose value and depreciate over time, intangible assets do not.

- Our long-standing sector experience has shown that assets are commonly insured for indemnity value rather than full reinstatement value, and the impact that this can have on replacement costs is often overlooked.

- This means you could write-off £4,500 of the van’s value as an expense against your taxes each year.

- These procedures include documenting financial records, calculating revenue, estimating fixed-asset valuations and complying with tax laws.

- The depreciation expense reported in each period is lower and net income is higher.

For example, a factory building may have an expected life of 50 years. If the lift in it has an expected life of 20 years, the lift is not a long-life asset even though the factory building has an expected life of 50 years. But if the lift has an expected life of 30 years, the lift as a whole is a long-life asset even if parts of the lift are likely to be replaced in less than 25 years. Suppose you are buying an asset through instalments or loan payments and you make a deposit. If a fixed-asset account does not already exist, you need to create one.

In a sale of plant assets, the book value of the asset is compared to the proceeds received from the sale. If the proceeds of the sale exceed the book value of the plant asset, a gain on disposal occurs. If the proceeds of the sale are less than the book value of the plant asset sold, a loss on disposal occurs. The 25 year test should be applied to an item of plant or machinery as a whole and not to its component parts. The rule in CAA01/S571 that any reference to plant or machinery includes a reference to a part of any plant or machinery cannot be used to exclude parts that are likely to be replaced within 25 years.

Rather than requiring an accounts payable clerk to know each specific destination account, this method allows them to work from the clearing account. The balance is usually 0.00 because the clearing account gets credited and the fixed-asset account is debited the same amount. Component accounting or component depreciation assigns different costs to different parts of a large property, plant or equipment asset.

The value of the asset depreciates over time and you can write off a certain amount as an expense against taxes every year. Although you may need to pay all of the expense up-front, you cannot deduct https://cryptolisting.org/ all of that expense from your taxes in one go. Usually, it is only the assets that have a useful life of more than a year – items like vehicles, property, and equipment – that you would depreciate.

Entities with property, plant and equipment stated at revalued amounts are also required to make disclosures under IFRS 13 Fair Value Measurement. Depreciation is a process of cost allocation , not asset valuation. Long-life asset expenditure is expenditure that is incurred on a long-life asset and that is not excluded from long-life asset treatment CA23730.

Entities record their purchase of a fixed asset on the balance sheet, Asset purchases used to be noted on a sources and uses of funds statement, which is now called a cash flow statement. We provide an accurate and consistent valuation approach across all business and plant locations, while our detailed reporting caters for the delineation of buildings and plant assets. Plant registers and allocation of value to help with EML and PML type studies can also be provided. For instance, let’s say your company buys a piece of machinery for £20,000. Rather than claiming for the asset in one financial year, businesses will instead use depreciation to move the asset’s cost from its balance sheet to its income statement. Both types of development expenditures relate to the creation of new products but one is expensed and the other is capitalized.

Generally Accepted Accounting Procedures form the standard used by the United States Securities and Exchange Commission . The International Financial Reporting Standards , headquartered in London, with the International Accounting Standards Board as its standards-forming board, provides common accounting practices for businesses worldwide. An asset is any resource that you own or manage with the expectation that it will yield continuing benefits or cash flows. An asset is also a resource the value of which you can dependably measure.