Perfil

- Cidade: Ribeirão Preto - SP

- Eu Sou:

Ao ligar diz ter me visto no site Guia Sexy.

Apresentação:

Contents: Course learning outcomes Questions About Accounting Terms #5 – Schaum’s Outline of Principles of Accounting Introduction to bookkeeping and accounting As such, owners cannot be held personally liable for debts incurred solely by the company. A certified public accountant is an accounting professional specially licensed to provide auditing, taxation, accounting, and consulting services. Create clear processes for recording transactions and events as soon as you start your business. Once you have a set process for documenting and reporting your finances, stick to it. Business owners use accounting to track their financial operations, meet legal obligations, and make stronger business decisions. Since this book is specifically aimed at providing information on financial and managerial accounting, let us get a basic introduction to them as well. Accounting takes care of the basic but crucial function of keeping records for a business. They also have to be interpreted so the end-user can understand and make viable decisions based on these records. Make sure you clearly understand every cost figure you use. Course learning outcomes Business moves fast, and many companies rely on in-progress projects and income to meet goals. But even if this applies to your business, continue to maintain accurate and timely records. Instead, accountants must commit to reporting both good and bad performance. All financial information, both negative and positive, is disclosed accurately. Maybe you’re simply striving to understand the financial underpinnings of your organization and make a positive impact in your current position. DepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. The book comprises a collection of solved problems in accounting principles so that readers can easily connect the dots. With over 26 years of experience in the financial industry, Ara founded ACap Asset Management in 2009. Questions About Accounting Terms It even includes the analysis of these financial statements. Effective bookkeeping requires an understanding of the firm’s basic accounts. These accounts and their sub-accounts make up the company’s chart of accounts. Basics of Accounting – Allianz Basics of Accounting. Posted: Fri, 25 Nov 2022 06:44:07 GMT [source] Credits are accounting entries that increase liabilities or decrease assets. They are the functional opposite of debits and are positioned to the right side in accounting documents. As important as it is to understand how business accounting works, you don’t have to do it alone. That’s where professional accounting services and CPAs come in. #5 – Schaum’s Outline of Principles of Accounting Income statements are therefore intended to show how profitable a business was during that recorded period of time, not necessarily how much money a business took in during that time. Accounting, a meticulous recording of financial transactions, is a crucial process required for the success of businesses both big and small. While large businesses will usually employ a sizable accounting department with many employees , smaller businesses may employ only a bookkeeper. What are the basics of accounting? What are the basics of accounting? Basic accounting concepts used in the business world cover revenues, expenses, assets, and liabilities. These elements are tracked and recorded in documents including balance sheets, income statements, and cash flow statements. Accounting is thinking about what your financial records will mean to regulators, agencies, and tax collectors. In business, accounting will be involved in various functions. It will help to make strategies, save money, and also to prevent expenditure beyond what is specified in a budget. Introduction to bookkeeping and accounting This can include loans, mortgages, bills that are not paid, and any money that is owed to another. You may have an accountant working for your business and have trusted them with your financial matters. Before you start proceeding with this tutorial, we assume that you have a basic understanding of commerce. Our easy online application is free, and no special documentation is required. If only bookkeeping meant hoarding the paperbacks I overbuy from my local bookstore — I’d be really good at that. Some companies decide to combine operating and SG&A expenses while some separate them . Software, apps, and cloud-based bookkeepers have made it a breeze to track expenses and not have to keep hundreds of receipts lying around. Check out solutions like Rydoo, Expensify, Zoho Expense, and Shoeboxed to help manage your expenses. Principle of Permanence of Methods We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping. Joe will no doubt start his business by putting some of his own personal money into it. In effect, he is buying shares of Direct Delivery’s common stock. When retained earnings are positive, they increase the organization’s equity. That equity may then be reinvested back into the business to fuel its future growth. However, they can also be offered as exceptional one-time bonuses. Debits are accounting entries that function to increase assets or decrease liabilities. They are the functional opposite of credits and are positioned to the left side in accounting documents. Revenues and expenses recognized by a company but not yet recorded in their accounts are known as accruals . By definition, accruals occur before an exchange of money resolves the transaction. Collecting money in person (at a storefront, marketplace, etc.) can get pricey. The cash method recognizes revenue and expenses on the day they’re actually received or paid. Other smaller firms may require reports only at the end of the year in preparation for doing taxes. Check out solutions like Rydoo, Expensify, Zoho Expense, and Shoeboxed to help manage your expenses. The Generally Accepted Accounting Principles are a blueprint for accounting across sectors and industries in the U.S. Under the principle of consistency, accountants must clearly state any changes in financial data on financial statements. Bookkeeping in a business firm is an important, but preliminary, function to the actual accounting function. Financial StatementFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . AuditorsAn auditor is a professional appointed by an enterprise for an independent analysis of their accounting records and financial statements. Accounts payable is money that you owe other people and is considered a liability on your balance sheet. For example, let’s say your company pays $5,000 in rent each month. Here’s how that would be recorded in your financial records before that amount is paid out. A profit and loss (P&L) statement is a snapshot of your business’s income and expenses during a given time period . This calculation will also be reflected on your business’s Schedule C tax document. A good P&L report highlights the key variables that drive performance for each major profit center of your business. It should serve like a well-used guide that directs you to the right destinations. You may need different formats for different profit centers in your business. A Small Business Owner’s Guide to Accounting in 2023 – The Motley Fool A Small Business Owner’s Guide to Accounting in 2023. Posted: Fri, 05 Aug 2022 07:00:00 GMT [source] Equity capital specifies the money paid into a business by investors in exchange for stock in the company. Debt capital covers money obtained through credit instruments such as loans. Even if you opt to use accounting software or hire a professional, use the tips we’ve reviewed in this guide to understand accounting basics. If you’re in charge of accounting, it’s not just numbers and receipts. It’s a process of gathering and reporting financial information. You’ll use those reports to communicate the cash flows, financial position, and performance of your business. Here, you’ll learn everything you need to know about integrating your accounting software with the rest of your company’s entire financial cycles and how it can transform your business. Take charge in choosing the accounting methods for your business and the design of your accounting reports. All too often, business managers adopt the policy that accounting is best left to the accountants. Unfortunately, this may result in your not fully understanding your own financial information. How do I start learning accounting? Begin your financial accounting education by learning how to read and analyze three key financial statements: the balance sheet, income statement, and cash flow statement. These documents contain valuable information about your company's spending, earnings, profit, and overall financial health. Examples of commonly used accounting periods include fiscal years, calendar years, and three-month calendar quarters. Each accounting period covers one complete accounting cycle. An accounting cycle is an eight-step system accountants use to track transactions during a particular period. Regardless of how you manage your business accounting, it’s wise to understand accounting basics. If you can read and prepare these basic documents, you’ll understand your business’s performance and financial health — as a result, you’ll have greater control of your company and financial decisions. Planning; the concept of planning is a continuous and futuristic process. The proper bookkeeper definitioning of financial data should be conducted with no expectation of performance compensation. It’s also a good idea to create processes so that your reporting stays consistent over time. All financial reporting methods should be consistent across time periods. This principle regulates how accounting works as a profession. By comparison, fixed costs remain the same regardless of production output or sales volume. As used in accounting, inventory describes assets that a company intends to liquidate through sales operations. It includes assets being held for sale, those in the process of being made, and the materials used to make them. A fixed cost is a cost that stays the same regardless of increases or decreases in a company’s output or revenues. What is the first step to do accounting? The first step in the accounting cycle is identifying transactions. Companies will have many transactions throughout the accounting cycle. Each one needs to be properly recorded on the company's books. Recordkeeping is essential for recording all types of transactions.

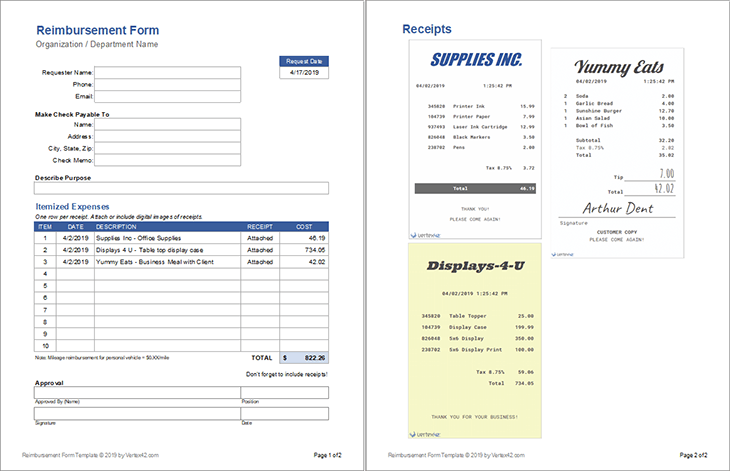

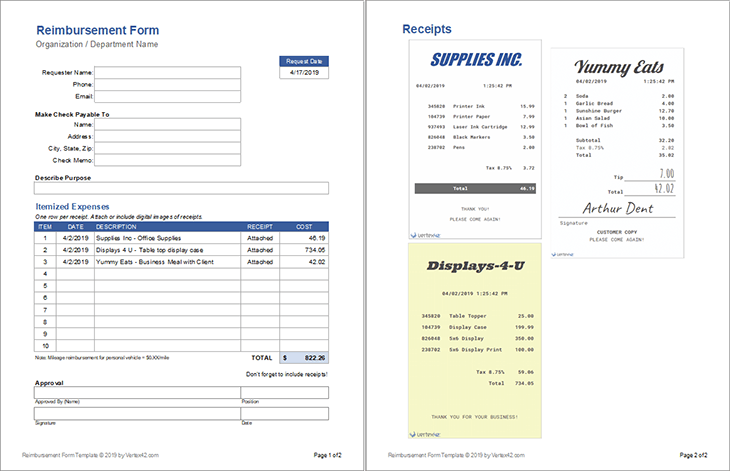

As such, owners cannot be held personally liable for debts incurred solely by the company. A certified public accountant is an accounting professional specially licensed to provide auditing, taxation, accounting, and consulting services. Create clear processes for recording transactions and events as soon as you start your business. Once you have a set process for documenting and reporting your finances, stick to it.

Business owners use accounting to track their financial operations, meet legal obligations, and make stronger business decisions. Since this book is specifically aimed at providing information on financial and managerial accounting, let us get a basic introduction to them as well. Accounting takes care of the basic but crucial function of keeping records for a business. They also have to be interpreted so the end-user can understand and make viable decisions based on these records. Make sure you clearly understand every cost figure you use.

Course learning outcomes

Business moves fast, and many companies rely on in-progress projects and income to meet goals. But even if this applies to your business, continue to maintain accurate and timely records. Instead, accountants must commit to reporting both good and bad performance. All financial information, both negative and positive, is disclosed accurately.

Maybe you’re simply striving to understand the financial underpinnings of your organization and make a positive impact in your current position. DepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. The book comprises a collection of solved problems in accounting principles so that readers can easily connect the dots. With over 26 years of experience in the financial industry, Ara founded ACap Asset Management in 2009.

Questions About Accounting Terms

It even includes the analysis of these financial statements. Effective bookkeeping requires an understanding of the firm’s basic accounts. These accounts and their sub-accounts make up the company’s chart of accounts.

Basics of Accounting – Allianz

Basics of Accounting.

Posted: Fri, 25 Nov 2022 06:44:07 GMT [source]

Credits are accounting entries that increase liabilities or decrease assets. They are the functional opposite of debits and are positioned to the right side in accounting documents. As important as it is to understand how business accounting works, you don’t have to do it alone. That’s where professional accounting services and CPAs come in.

#5 – Schaum’s Outline of Principles of Accounting

Income statements are therefore intended to show how profitable a business was during that recorded period of time, not necessarily how much money a business took in during that time. Accounting, a meticulous recording of financial transactions, is a crucial process required for the success of businesses both big and small. While large businesses will usually employ a sizable accounting department with many employees , smaller businesses may employ only a bookkeeper.

What are the basics of accounting?

What are the basics of accounting? Basic accounting concepts used in the business world cover revenues, expenses, assets, and liabilities. These elements are tracked and recorded in documents including balance sheets, income statements, and cash flow statements.

Accounting is thinking about what your financial records will mean to regulators, agencies, and tax collectors. In business, accounting will be involved in various functions. It will help to make strategies, save money, and also to prevent expenditure beyond what is specified in a budget.

Introduction to bookkeeping and accounting

This can include loans, mortgages, bills that are not paid, and any money that is owed to another. You may have an accountant working for your business and have trusted them with your financial matters. Before you start proceeding with this tutorial, we assume that you have a basic understanding of commerce. Our easy online application is free, and no special documentation is required.

If only bookkeeping meant hoarding the paperbacks I overbuy from my local bookstore — I’d be really good at that. Some companies decide to combine operating and SG&A expenses while some separate them . Software, apps, and cloud-based bookkeepers have made it a breeze to track expenses and not have to keep hundreds of receipts lying around. Check out solutions like Rydoo, Expensify, Zoho Expense, and Shoeboxed to help manage your expenses.

Principle of Permanence of Methods

We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping. Joe will no doubt start his business by putting some of his own personal money into it. In effect, he is buying shares of Direct Delivery’s common stock. When retained earnings are positive, they increase the organization’s equity. That equity may then be reinvested back into the business to fuel its future growth.

However, they can also be offered as exceptional one-time bonuses. Debits are accounting entries that function to increase assets or decrease liabilities. They are the functional opposite of credits and are positioned to the left side in accounting documents. Revenues and expenses recognized by a company but not yet recorded in their accounts are known as accruals . By definition, accruals occur before an exchange of money resolves the transaction. Collecting money in person (at a storefront, marketplace, etc.) can get pricey.

- The cash method recognizes revenue and expenses on the day they’re actually received or paid.

- Other smaller firms may require reports only at the end of the year in preparation for doing taxes.

- Check out solutions like Rydoo, Expensify, Zoho Expense, and Shoeboxed to help manage your expenses.

- The Generally Accepted Accounting Principles are a blueprint for accounting across sectors and industries in the U.S.

Under the principle of consistency, accountants must clearly state any changes in financial data on financial statements. Bookkeeping in a business firm is an important, but preliminary, function to the actual accounting function. Financial StatementFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . AuditorsAn auditor is a professional appointed by an enterprise for an independent analysis of their accounting records and financial statements.

Accounts payable is money that you owe other people and is considered a liability on your balance sheet. For example, let’s say your company pays $5,000 in rent each month. Here’s how that would be recorded in your financial records before that amount is paid out. A profit and loss (P&L) statement is a snapshot of your business’s income and expenses during a given time period . This calculation will also be reflected on your business’s Schedule C tax document.

A good P&L report highlights the key variables that drive performance for each major profit center of your business. It should serve like a well-used guide that directs you to the right destinations. You may need different formats for different profit centers in your business.

A Small Business Owner’s Guide to Accounting in 2023 – The Motley Fool

A Small Business Owner’s Guide to Accounting in 2023.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

Equity capital specifies the money paid into a business by investors in exchange for stock in the company. Debt capital covers money obtained through credit instruments such as loans. Even if you opt to use accounting software or hire a professional, use the tips we’ve reviewed in this guide to understand accounting basics. If you’re in charge of accounting, it’s not just numbers and receipts. It’s a process of gathering and reporting financial information. You’ll use those reports to communicate the cash flows, financial position, and performance of your business.

Here, you’ll learn everything you need to know about integrating your accounting software with the rest of your company’s entire financial cycles and how it can transform your business. Take charge in choosing the accounting methods for your business and the design of your accounting reports. All too often, business managers adopt the policy that accounting is best left to the accountants. Unfortunately, this may result in your not fully understanding your own financial information.

How do I start learning accounting?

Begin your financial accounting education by learning how to read and analyze three key financial statements: the balance sheet, income statement, and cash flow statement. These documents contain valuable information about your company's spending, earnings, profit, and overall financial health.

Examples of commonly used accounting periods include fiscal years, calendar years, and three-month calendar quarters. Each accounting period covers one complete accounting cycle. An accounting cycle is an eight-step system accountants use to track transactions during a particular period. Regardless of how you manage your business accounting, it’s wise to understand accounting basics. If you can read and prepare these basic documents, you’ll understand your business’s performance and financial health — as a result, you’ll have greater control of your company and financial decisions. Planning; the concept of planning is a continuous and futuristic process.

The proper bookkeeper definitioning of financial data should be conducted with no expectation of performance compensation. It’s also a good idea to create processes so that your reporting stays consistent over time. All financial reporting methods should be consistent across time periods. This principle regulates how accounting works as a profession.

By comparison, fixed costs remain the same regardless of production output or sales volume. As used in accounting, inventory describes assets that a company intends to liquidate through sales operations. It includes assets being held for sale, those in the process of being made, and the materials used to make them. A fixed cost is a cost that stays the same regardless of increases or decreases in a company’s output or revenues.

What is the first step to do accounting?

The first step in the accounting cycle is identifying transactions. Companies will have many transactions throughout the accounting cycle. Each one needs to be properly recorded on the company's books. Recordkeeping is essential for recording all types of transactions.